Compute present value

Examplediscounted present value or DPV. If you want all seven magnetic field components for a single day or range of years from 1900-present please visit our Magnetic Field CalculatorPlease read the instructions below before using this calculator.

Calculating Present Value Of An Annuity Ti 83 84 141 35 Youtube Annuity Calculator Investing

Calculation Using a PV of 1 Table Use the PV of 1 table to find the rounded present value factor at the intersection of n 20 and i 10.

. Test_list Gfg is Good. The business intends to receive an income of 120000 for infinite tenure. If the remapping function returns null the mapping is removed.

Williamson Seven Ways to Compute the Relative Value of a US. Present Value - PV. The maturity amount which occurs at the end of the 10th six-month period is represented by FV The present value of 67600 tells us that an investor requiring an 8 per year return compounded semiannually would be willing to invest 67600 in return for a.

Python3 Python3 code to demonstrate working of Extract Keys Value if Key Present in List and Dictionary. Present Value Of An Annuity Based on your inputs this is the present value of the annuity you entered information for. Using the broader based GDP deflator gives a present cost of 147 billion.

To find out the present value the amount of 5000 to be received in future would be discounted using. Def entropyA axisNone. In the Value field type DONE.

Enter number of weeks to compute. Future cash flows are discounted at the discount. This calculator computes a Present Value factor of Future Payments discounted at a discount rate of 60.

Lets use the following formula to compute the present value of the maturity amount only of the bond described above. The premise behind the calculation is the concept of the time value of money or in other words that its more valuable to receive something today than to receive the same value at a future date which is why. ComputeresourcePoliciescreate on the project or organization.

Computes the Shannon entropy of the elements of A. Present value is a formula used in finance that calculates the present day value of an amount that is received at a future date. Dollar Amount 1790 to present MeasuringWorth.

The expected value EV is an anticipated value for a given investment. See How Finance Works for the present value formula. Compute present value of this sum if the current market interest rate is 10 and the interest is compounded annually.

Pound Amount 1270 to present MeasuringWorth 2022. The currently calculated monthly payment. If the remapping function itself throws an unchecked exception the exception is rethrown and the current mapping is left unchanged.

Annual Coupon Rate is the yield of the bond as of its issue date. By default localhost is pre-selected if the target matches your current local platform. Select the target machine at the top of the dialog to connect and update the list of attachable applications.

Annual Market Rate is the current market rate. Face Value is the value of the bond at maturity. Attach u2013 This value is used when you are using a specialized disk to create the virtual machine.

Bond Present Value Calculator. The currently calculated annual payment. Finding the amount you would need to invest today in order to have a specified balance in the future.

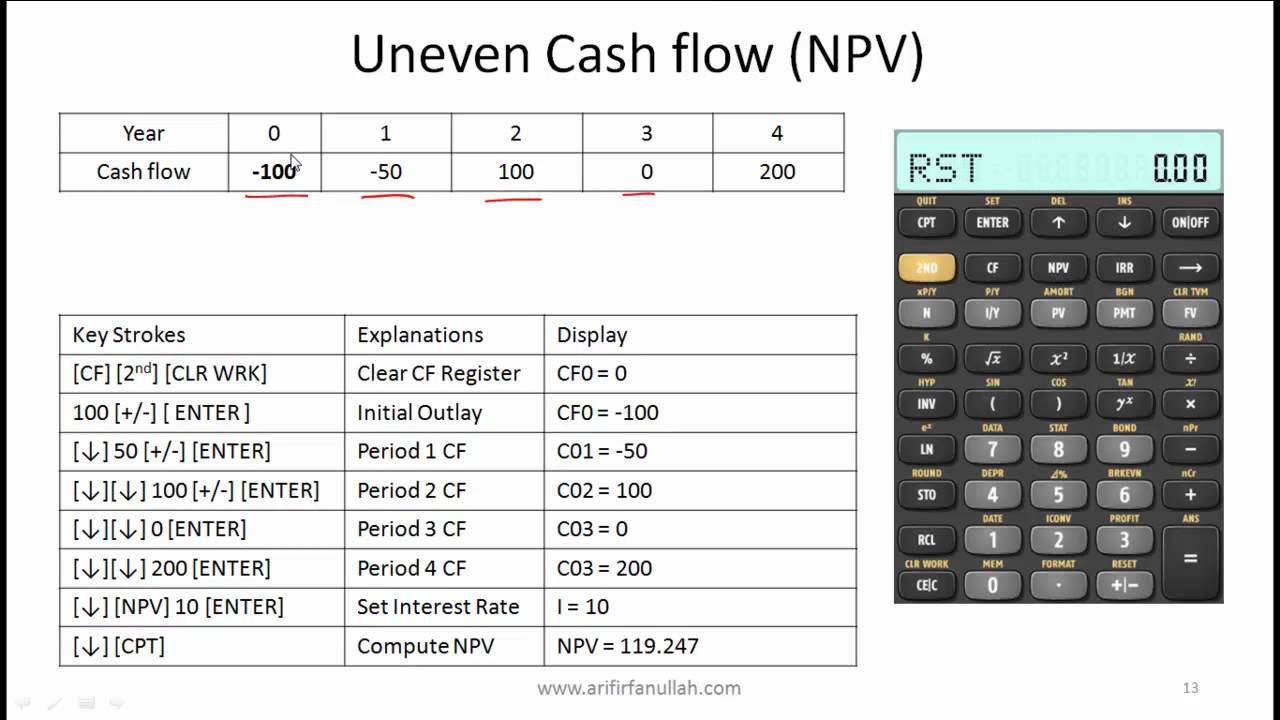

The cash inflow generated by the project is uneven. It is also referred to as discount rate or yield to maturity. Compute the total value of dividend income as displayed below.

If the function itself throws an unchecked exception the exception is rethrown and the current mapping is left unchanged. Compute net present value of the project if the minimum desired rate of return is 12. FromImage u2013 This value is used when you are using an image to create the virtual machine.

Value from present value of 1 table. PaymentWithdrawal Frequency The paymentdeposit frequency you want the present value annuity calculator to use for the present value calculations. If you want only the magnetic declination variation for a single day between 1900-present visit our declination calculator.

Attach u2013 This value is used when you are using a specialized disk to create the virtual machine. Please input a number between 1 and 5005. Click Show advanced options.

Using the formula to determine the present value we have. In statistics and probability analysis the EV is calculated by multiplying each of the possible outcomes by. In the Advanced aggregation pane click the.

The interval can be monthly quarterly semi-annually or annually. If the value for the specified key is present and non-null attempts to compute a new mapping given the key and its current mapped value. If you are using a platform image you also use the imageReference element described above.

Therefore the present value would be computed for each year separately. Assumes A is an array-like of nonnegative ints whose max value is approximately the number of unique values present. Use the Bond Present Value Calculator to compute the present value of a bond.

In this we compute the intersection of all values of list and dict keys and test for the Keys occurrence in that. An alternative would be to use the production worker index as a rough measure of the labor cost in current terms and that would be 242 billion. In addition you can use the calculator to compute the monthly and annual payments to save a certain amount of money future value for retirement education etc.

FromImage u2013 This value is used when you are using an image to create the virtual machine. Five Ways to Compute the Relative Value of a UK Pound Amount 1270 to Present. You will use one or more variables to define the conditions under which your computation should be applied to the data.

If the value for the specified key is present and non-null attempts to compute a new mapping given the key and its current mapped value. If you are using a platform image you also use the imageReference element described above. Step 6 To arrive at the present value of the perpetuity divide the cash flows with the resulting value determined in step 5.

Click If indicated by letter E in the above image to open the Compute Variable. 1 The left column displays all of the variables in your dataset. To calculate the present value of receiving 1000 at the end of 20 years with a 10 interest rate insert the factor into the formula.

You can also sometimes estimate present value with The Rule of 72. The --daily-schedule flag must be present but not set to anything. If the function returns null the mapping is removed.

The project seems attractive because its net present value is positive. Possible values are. Present value is compound interest in reverse.

Among other places its used in the theory of stock valuation. Extract Keys Value if Key Present in List and Dictionary initializing list. Five Ways to Compute the Relative Value of a UK.

2 The default specification is to Include all casesTo specify the conditions under which. The present value of an amount means todays value of the amount to be received at a point of time in future. Enter initial year before entering the initial amount and enter amount as a number without a sign or commas.

Select the Attach tab and the target application of interest and press AttachOnce connected the layout of NVIDIA Nsight Compute changes into stepping mode that allows you. Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return. Let us then take the example of a trading business.

See also our Annuity Mortgage and Loan Future Value. Possible values are.

Annuity Formula Present Value Annuity Formula Annuity Formula

Compute Net Present Value Using Excel S Npv Function Youtube Excel Excel Formula Function

1 Ba Ii Plus Cash Flows Net Present Value Npv And Irr Calculations Youtube Cash Flow Calculator Financial Decisions

Texas Instruments Ba Ii Plus Tutorial For The Cfa Exam By Mr Arif Irfanullah Youtube Exam Financial Calculator Tutorial

Pv Function Learning Microsoft Excel Excel Templates

Time Value Of Money Calculations On The Ba Ii Plus Calculator Youtube Time Value Of Money Make More Money Calculator

Present Value And The Opportunity Cost Of Capital Mgt535 Lecture In Hindi Urdu 03 Youtube Cost Of Capital Opportunity Cost Lecture

Accurate Business Valuation In Singapore Business Valuation Investing Business

80x Table Formula 05 Portable 3 1 Normal

Pmp Certification Formulas Present Value Tipsographic Formula Pmbok Pmp Exam

James Stith This Shows In Different Terms And Currency To Calculate Accounting Rate Of Return Arr Cash Flow Statement Financial Statement Investing

Investment Appraisal Calculating Net Present Value Investing Business And Economics Appraisal

Corporate Finance 8 Time Value Of Money Pv Fv Time Value Of Money Money Concepts Online Course Creation

Calculating Present And Future Value Of Annuities Annuity Time Value Of Money Annuity Formula

Formula For Calculating Net Present Value Npv In Excel Formula Excel Economics A Level

Present Value Of Uneven Cash Flows All You Need To Know Cash Flow Financial Life Hacks Financial Management

Decision Making Using Npv Decision Making Investing Flow Chart